Round Table Financial Update – 10/18/2022

So Much Trouble and Uncertainty In The World

The following are thoughts from our Financial Advisor, Bob Randolph, on current market conditions:

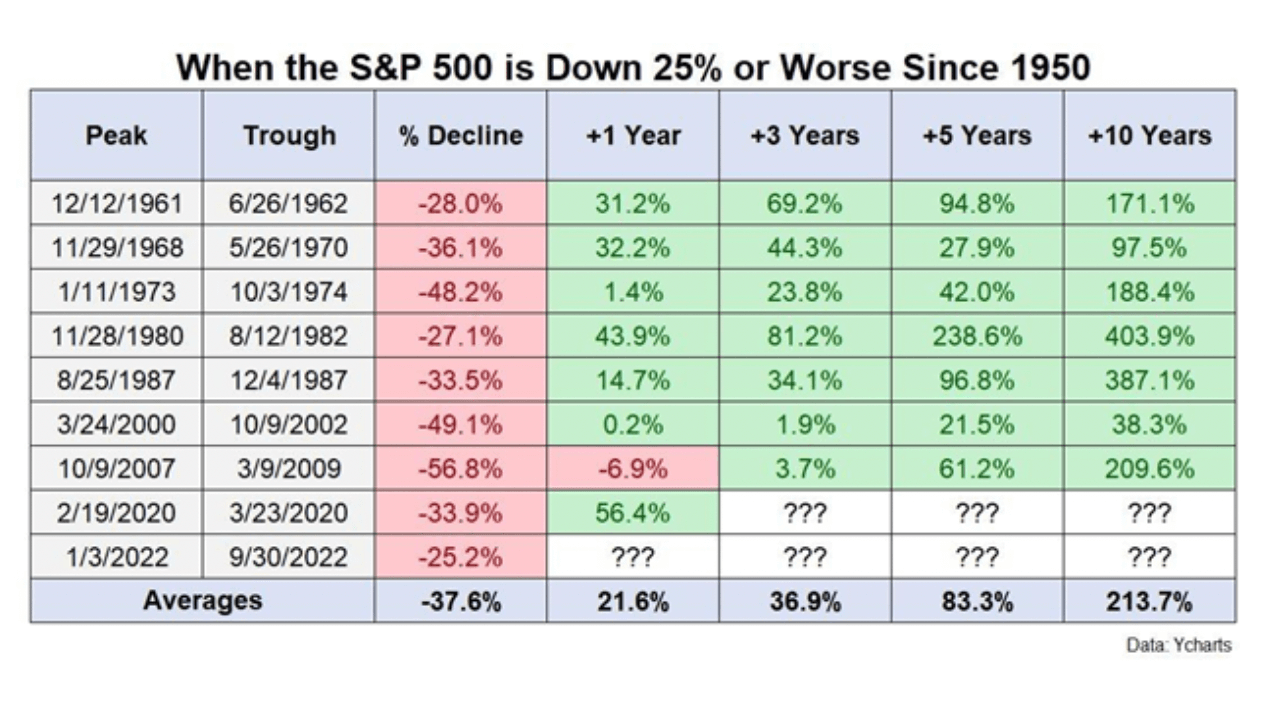

It has been a bleak year for the U.S. stock market which, despite some short-term rallies, is still firmly entrenched in bear market territory. The S&P 500 is down 25% in 2022. The war in Ukraine, China’s lockdown and saber rattling, OPEC+’s cutting oil production, financial flip-flopping in the UK and a very aggressive Federal Reserve trying to tackle runaway inflation make a strong case for market bears and a global recession.

Since 1950, whenever stocks have been in a similar situation, they have generally gained around 20% on average over the next year and 214% on average over the next 10 years. This brings to mind an old market adage, time in the market beats timing the market.

Investors are moving from a TINA (there is no alternative) to a TARA (there are reasonable alternatives) mindset. With the rise in short-term interest rates, cash is starting to look relatively more attractive as an investment. With the one-year Treasury bill yielding close to 4.50% it is a pretty attractive rate of return compared with the risk-adjusted returns to be had in the equity markets.

I continue to move available cash out of bank and similar accounts paying almost zero into short-term treasuries where appropriate and screen for equities with strong balance sheets and sustainable dividends.